Casual Info About How To Increase Days Payable Outstanding

/days-payable-outstanding-4197475-01-FINAL-9982e5c8025840c2913e1c13e4c6d6aa.png)

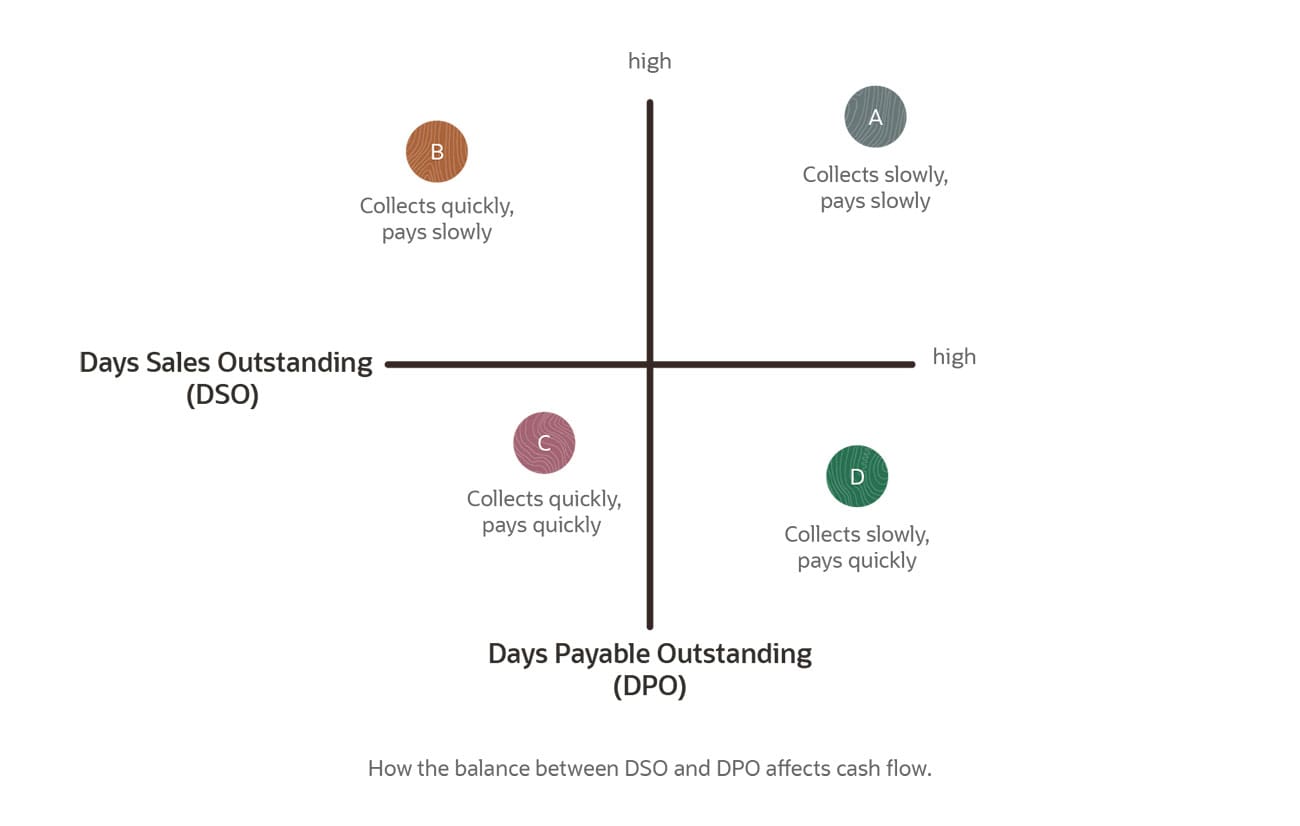

To improve your days payable outstanding ratio, you’ll need to optimize accounts payable.

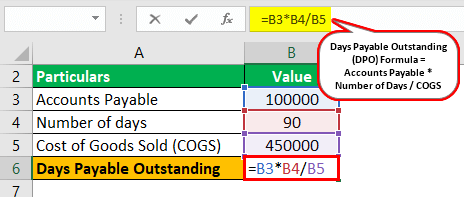

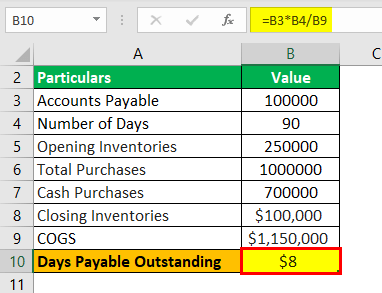

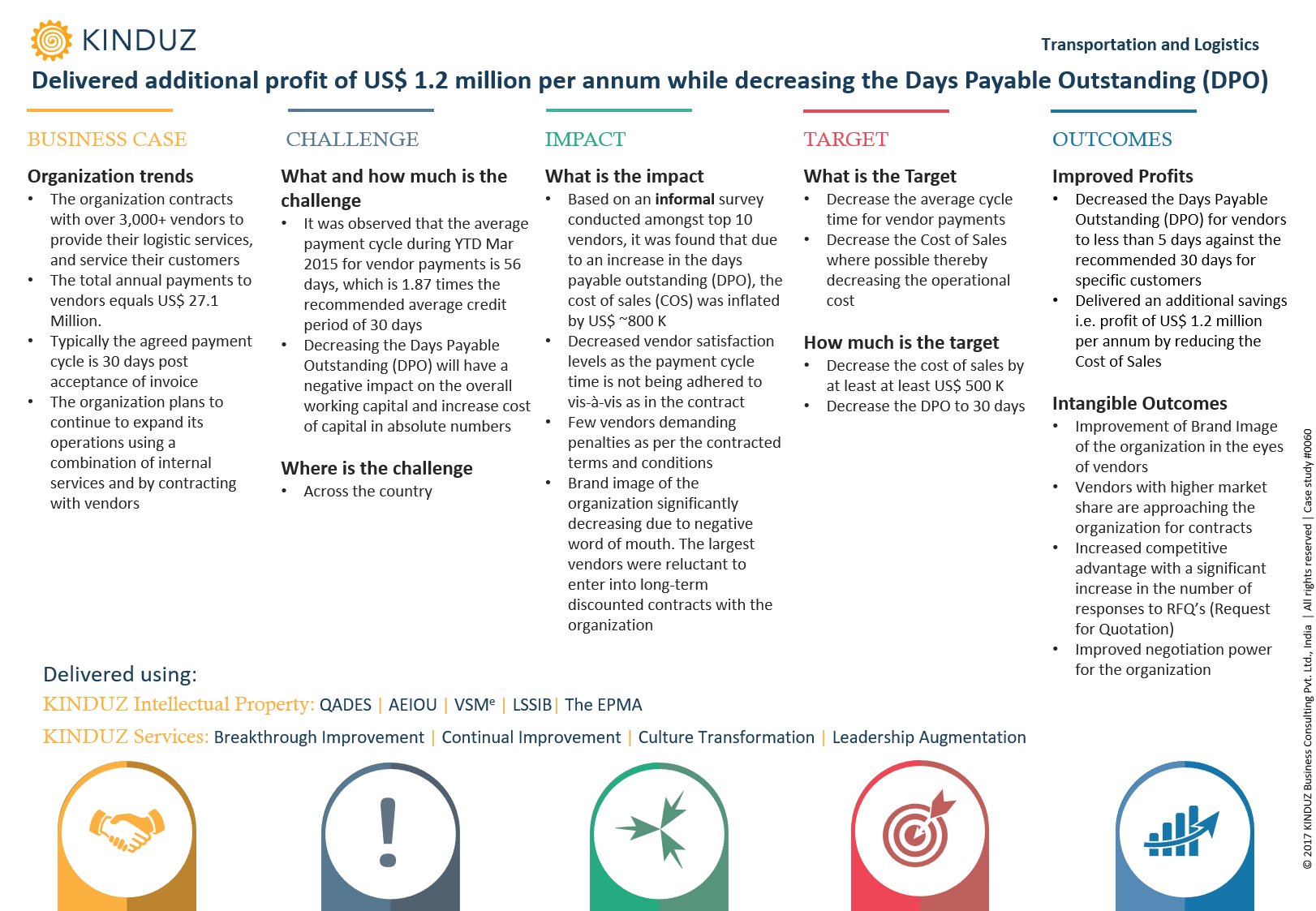

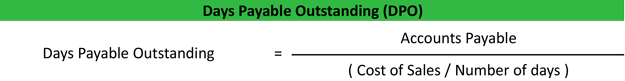

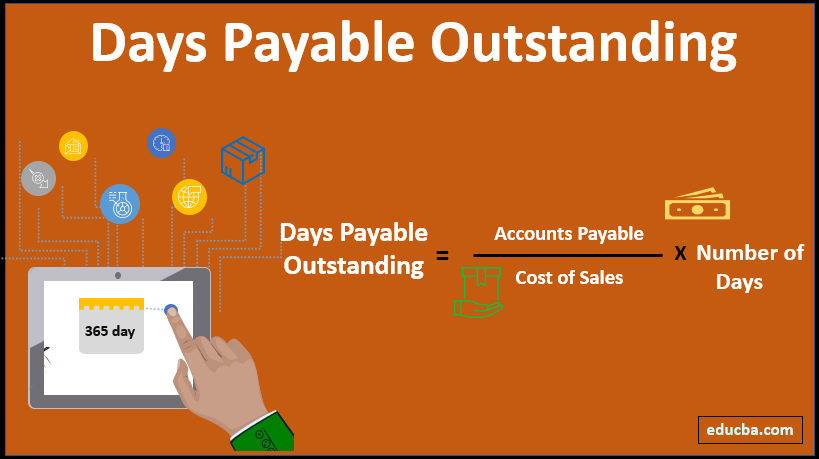

How to increase days payable outstanding. Web in order to calculate a company’s days payable outstanding, or “dpo”, the first step is to take the average (or ending) accounts payable balance and divide it by cogs. To improve your days payable outstanding ratio, you’ll need to optimise accounts payable. By taking a strategic approach, you can free up.

The days payable outstanding formula is listed in two forms below: Web 5 tips to improve days payable outstanding delay payments. To improve your days payable outstanding ratio, you'll need to optimise accounts payable.

To determine how many days it takes, on average, for a company’s accounts receivable to be realized as cash, the. Web getting longer payment terms enables you to increase days payable outstanding. Web what is the formula for days sales outstanding?

Web how to calculate days payable outstanding? Web lengthen the time to 35 days for several months and then 40 days, etc. Our calculations show that amazon keeps its cash.

The mathematical formula for days payable outstanding equals the number of days in a year divided by accounts. Web ask for a longer payment window, or a discount for faster payment. Web how to improve days payable outstanding.

You may even be willing to sacrifice your dpo a bit if it means getting early. The source for strategic sourcing tips, procurement news, and category management sme from corcentric's procurement consultants The most obvious answer to improving days payable outstanding is to delay payments.

:max_bytes(150000):strip_icc():gifv()/days-payable-outstanding-4197475-01-FINAL-9982e5c8025840c2913e1c13e4c6d6aa.png)